Intel plans to lower greater than 15% of its workforce, some 17 500 individuals, and droop its dividend beginning within the fourth quarter because the chip maker pursues a turnaround targeted on its money-losing manufacturing enterprise.

Intel plans to lower greater than 15% of its workforce, some 17 500 individuals, and droop its dividend beginning within the fourth quarter because the chip maker pursues a turnaround targeted on its money-losing manufacturing enterprise.

It additionally forecast third-quarter income beneath market estimates, grappling with a pullback in spending on conventional information centre semiconductors and a deal with AI chips, the place it lags rivals.

Shares of Santa Clara, California-based Intel slumped 20% in prolonged commerce, setting the chip maker as much as lose greater than US$24-billion in market worth. The inventory had closed down 7% on Thursday, in tandem with a plunge in US chip shares after a conservative forecast from ARM Holdings on Wednesday.

The outcomes didn’t rock the broader chip business.

AI powerhouse Nvidia and smaller rival AMD ticked up after hours, underscoring how well-positioned they have been to reap the benefits of the AI increase, and Intel’s relative drawback.

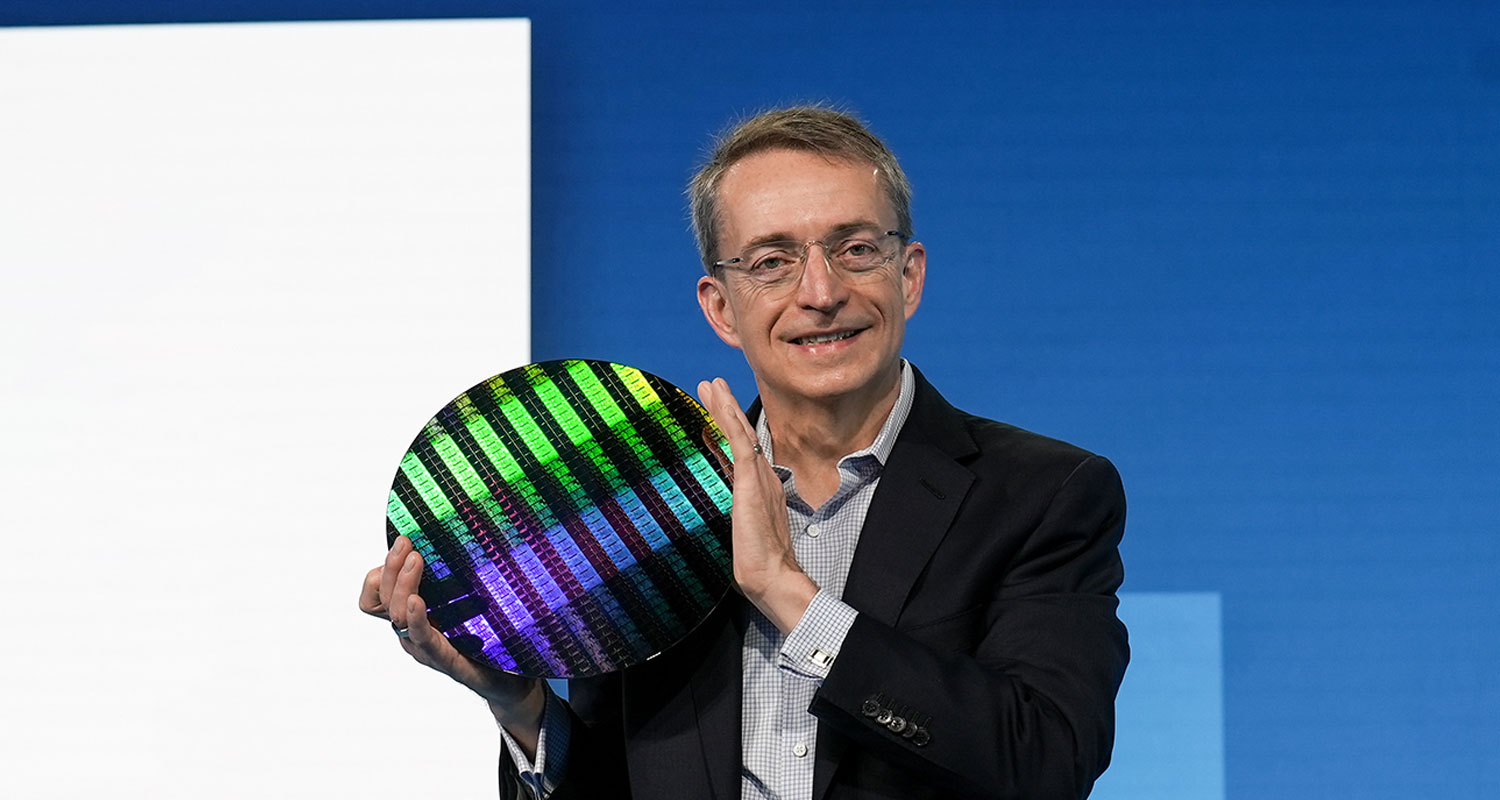

“I want much less individuals at headquarters, extra individuals within the area, supporting prospects,” CEO Pat Gelsinger stated in an interview, speaking in regards to the job cuts. On the dividend suspension, he stated: “Our goal is to … pay a aggressive dividend over time, however proper now, specializing in the steadiness sheet, deleveraging.”

Intel, which employed 116 500 individuals as of 29 June, excluding some subsidiaries, stated nearly all of the job cuts can be accomplished by the tip of 2024. In April, it declared a quarterly dividend of US$0.125/share.

Spending slashed

Intel is in the midst of a turnaround plan, targeted on creating superior AI processors and building-out its for-hire manufacturing capabilities, because it goals to recoup the technological edge it misplaced to Taiwan’s TSMC, the world’s largest contract chip maker.

The push to energise that contracting foundry enterprise below Gelsinger has elevated Intel’s prices and pressured revenue margins. Extra lately, the chip maker has stated it is going to lower prices.

On Thursday, Intel introduced it might lower working bills and cut back capital expenditure by greater than $10-billion in 2025, greater than it initially deliberate.

Learn: Intel CEO fires again at Nvidia in AI chips battle

“A $10-billion value discount plan reveals that administration is keen to take sturdy and drastic measures to proper the ship and repair issues. However we’re all asking, ‘is it sufficient’ and is it a little bit of a late response contemplating that CEO Gelsinger has been on the helm for over three years?” stated Michael Schulman, chief funding officer of Working Level Capital.

The corporate had money and money equivalents of $11.3-billion, and complete present liabilities of about $32-billion, as of 29 June.

Intel’s lagging place available in the market for AI chips has despatched its shares down greater than 40% thus far this yr.

For the third quarter, Intel expects income of $12.5-billion to $13.5-billion, in contrast with analysts’ common estimate of $14.35-billion, LSEG information confirmed. It forecast adjusted gross margin of 38%, properly wanting market expectations of 45.7%.

Analysts consider Intel’s plan to show across the foundry enterprise will take years to materialise and anticipate TSMC to take care of its lead, at the same time as Intel has ramped up manufacturing of AI chips for PCs. The PC chip enterprise grew 9% within the April-to-June quarter.

“The irony is that … their first AI PC-focused processors are promoting a lot better than anticipated. The issue is that the prices for these chips are a lot greater, that means their profitability on them isn’t nice,” stated Bob O’Donnell, chief analyst at Technalysis Analysis.

“As well as, the info centre decline reinforces the truth that whereas corporations are shopping for plenty of infrastructure for AI, the overwhelming majority is for non-Intel GPUs,” he stated, referring to graphic processing items like these offered by Nvidia.

Intel’s information centre enterprise declined 3% within the quarter.

Chief monetary officer David Zinsner stated on a post-earnings name that the chip maker expects weaker client and enterprise spending within the present quarter, particularly in China.

China

Export licences that have been revoked in Can also damage Intel’s enterprise in China within the second quarter, he stated. Intel stated in Could its gross sales there would take a success after Washington revoked a few of the chip maker’s export licences for a buyer in China.

Intel can be slashing investments.

It expects to chop capital bills by 17% in 2025 year-on-year to $21.5-billion, calculated on the midpoint of a variety the chip maker forecast. It expects these prices to remain roughly flat in 2024. — Arsheeya Bajwa, with Max Cherney, Noel Randewich and Juby Babu, (c) 2024 Reuters