- Startups in Africa have attracted over $1.2 billion in financing this 12 months.

- Consultants notice that debt financing for startups in Africa is more and more taking centre stage.

- In July, startups d.gentle, Va1U, Terrapay in addition to Cartona all settled on debt financing to spice up operations.

Startups in Africa have defied the chances in declining world capital circulation, attracting a document $420 million in financing in July. This funding, which excludes exits, takes to $1.2 billion the sum of money channeled to startups in Africa this 12 months and is the very best on document in 14 months.

“The numbers have been closely skewed by the 2 mega offers that have been introduced throughout the month: d.gentle’s $176 million securitisation facility and MNT-Halan’s $157.5 million elevate. NALA’s $40 million Collection A additionally deserves a point out. Mixed, these three offers characterize 90 % of the funding raised,” an replace by startup funding tracker, Africa: The Huge Deal states.

“This nice month-to-month efficiency implies that the ecosystem was ready not solely to comfortably cross the $1 billion mark by way of funding raised in 2024 thus far ($1.2 billion), but in addition to high the quantity raised in 2020. The following milestone—the $1.4 billion raised in 2019—is now inside attain,” it added.

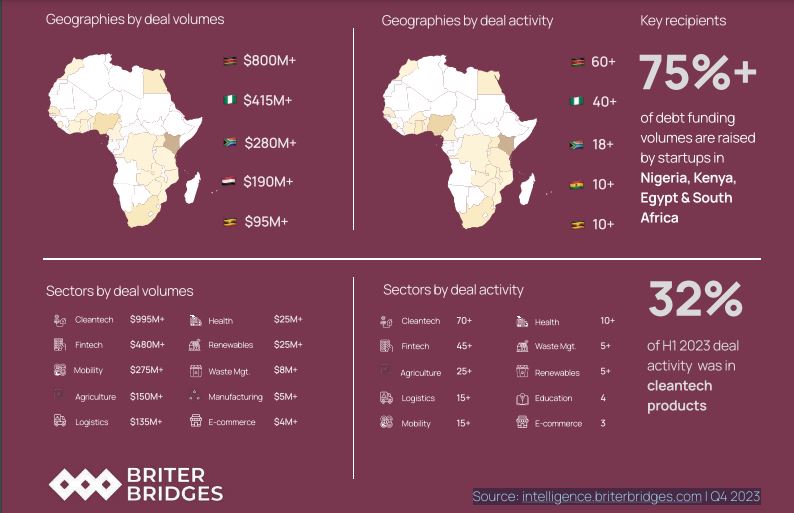

A comparable evaluation by United Kingdom-based Briter Bridges Ltd reveals that in July, over 110 startup financing offers have been reported throughout key economies in Africa, constituting diversified sources of capital.

In accordance with Briter Bridges, traders in startups are more and more choosing diversified devices of offering capital past conventional fairness.

For instance, in July, a complete of 5 startups reported debt offers whereas 23 startups settled for capital offers within the mould of grants or awards. On the similar time, an estimated 40 startups agreed on different types of enterprise help reminiscent of mentoring and enterprise information to drive enlargement.

Debt financing is now a key supply of capital for startups in Africa

Briter Bridges report underscores the rising function of debt within the provision of capital for startups in Africa. On this facet, July didn’t disappoint with 5 entities reporting debt offers, together with two main securitisation agreements.

The UK-based insights and enterprise advisory agency observes that debt financing constituted over a 3rd or 35 % of the full funding recorded in July.

For instance, d.gentle a startup that specialises in offering a platform for communities dwelling in off-grid areas to entry solar-powered tools introduced securitisation deal amounting to $176 million. This was the second deal of its variety for d.gentle this 12 months.

d.gentle famous that this funding, which was secured from African Frontier Capital, will improve its pay-as-you-go providing, thereby seeing it attain extra clients in Kenya, Tanzania, and Uganda, giving them inexpensive photo voltaic lanterns payable in installments.

In the identical vein, Egypt-based fintech Va1U introduced that it agreed on a $24 million securitisation funding plan from EFG Holding. This newest financing will see Va1U develop its purchase now, pay later platform for its rising buyer base within the north African market.

Nonetheless on debt financing, July noticed Terrapay accept $95 million in debt financing from two sources: The Worldwide Finance Company (IFC) and the British Worldwide Funding (BII).

Terrapay famous that this contemporary financing will see it speed up the event of its merchandise which might be geared towards chopping the price of remittances in Sub-Saharan Africa, which at present ranks the very best globally.

Within the month below focus, one other startup, Cartona, secured debt financing from Camel Ventures and GlobalCorp amounting to $2.5 million. Cartona introduced that this financing will supply the startup extra working capital and assist it to attach its consumers and sellers throughout its market in Egypt.

Learn additionally: Local weather tech startups in Africa defy odds, see document surge in financing to $325 million

Why startups in Africa are going for debt financing

July offers are merely pointers that debt is on the rise in Africa’s startup ecosystem. Startup founders and CEOs are drifting in the direction of debt financing “pushed by a mix of a fast decline in fairness funding, improvements in debt financing, and a greater understanding of if and the place debt can finest meet the funding wants for startups,” observes Briter Bridges.

In recent times, startups in Africa inside the cleantech and fintech segments are those attracting probably the most capital within the type of debt funding. Nevertheless, Briter Bridges notes that cleantech’s debt funding goes to “{hardware} asset heavy companies that may borrow in opposition to the underlying asset.”

“The rise of debt is a optimistic signal for the ecosystem, however must keep away from being a hammer searching for nails. It is going to proceed to extend, particularly over the subsequent 12 months, but it surely must be seen as a part of a variety of funding devices and help that may finest unlock sustainable funding and innovation ecosystems throughout Africa.

“In lots of instances, debt might not be applicable for startups and in others it could be extra applicable for revolutionary enterprise and initiatives that aren’t startups, reminiscent of financing wind or photo voltaic farm initiatives,” Briter Bridges Q3 2023 Debt financing in Africa’s innovation ecosystem report notes partly.

Funding for early-stage startups gathering tempo, too

One other excellent pattern in July was elevated urge for food by enterprise capitalists to channel their financing to early-stage startups.

“Incubator and accelerator programmes proceed to contribute to Africa’s startup ecosystem by offering helpful information, mentoring, and infrequently small quantities of capital to assist founders develop their options,” Briter Bridges notes in its July transient.

Within the month, a complete of 11 completely different incubation and acceleration packages chosen over 65 startups in Africa, providing numerous types of help to focus on entities.

“Out of the 11 packages, 5 offered grant funding, contributing lower than 1% to the full funding in July,” Briter Bridges observes.