US microchip big Intel is on the lookout for a brand new CEO following Pat Gelsinger’s shock resignation. This represents greater than only a company shakeup. It’s the tip of an period through which one firm may completely management a strategically important American know-how.

Below Intel’s roof is your complete course of for making laptop chips – from analysis to design to complicated fabrication. For a lot of the late twentieth century, this made the Californian firm a paragon of American ingenuity.

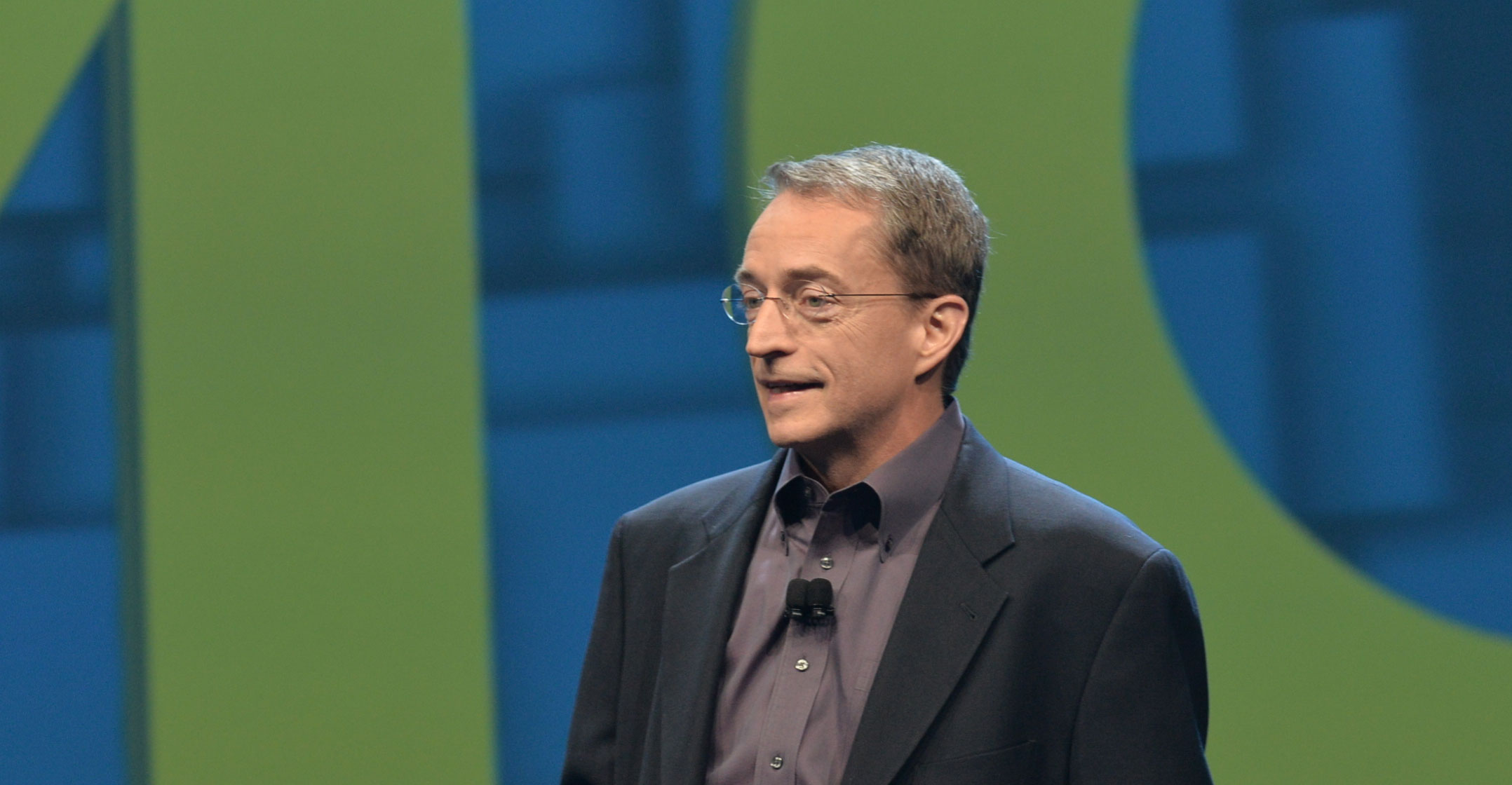

Gelsinger has been a lifer at Intel. He rose to chief know-how officer within the 2000s earlier than leaving for a decade to run Dell’s information storage to cloud computing enterprise, EMC.

His return as CEO in 2021 was seen as messianic. He promised the return of America’s chipset manufacturing supremacy from rivals like Taiwan Semiconductor Manufacturing Firm (TSMC).

His imaginative and prescient concerned funnelling billions of {dollars} into increasing chip-making factories in New Mexico and Oregon, and constructing vegetation in Ohio and Germany. To assist allow this, the federal authorities dedicated US$7.9-billion in subsidies as a part of President Joe Biden’s Chips Act 2022.

Three years later, the corporate is in disaster. The board gave Gelsinger a alternative: retire or be eliminated, so he selected the previous.

Intel’s strategic significance

The US authorities has at all times nurtured the nation’s trade in semiconductors, the tiny chips discovered inside laptops and smartphones. Way back to the late Nineteen Fifties it was paying 30 occasions the market charge for transistors for missile computer systems to California-based Fairchild Semiconductor, whose senior executives would later discovered Intel.

Semiconductors stay the lifeblood of the navy, from hypersonic missiles to AI-powered defence methods. But essentially the most superior ones are predominantly fabricated by TSMC in Taiwan, together with for American F-35 fighter jets.

China, after all, needs management of the island nation with which it was once united. Whoever controls Taiwan’s semiconductor capabilities, in response to a US congressional fee again in 2022, can have “the higher hand in each area of warfare” – to not point out an trade on the coronary heart of world commerce and society.

Learn: Intel board misplaced confidence in CEO Pat Gelsinger

To complicate issues, main American semiconductor corporations like Nvidia, AMD and Qualcomm personal no factories, and all rely closely for chip-making on TSMC/Taiwan, in addition to Samsung/South Korea. The US has duly induced TSMC and Samsung to construct vegetation respectively in Arizona and Texas. But because the final of the absolutely built-in US semiconductor producers, no firm has been extra central than Intel to America’s technique to convey chip-making again dwelling.

The burden of historical past

Intel’s built-in mannequin lengthy made it the king of Silicon Valley, nevertheless it missed an important alternative within the wake of the cell revolution. It continued specializing in costly, power-hungry CPUs for PCs and servers, failing to prioritise the lighter, extra energy-efficient processors utilized in smartphones. It neither introduced out its personal chips, nor adopted the recommendation of trade observers to reflect the TSMC mannequin of producing them for different corporations.

This is able to have generated sufficient money to be early in funding the brutally costly analysis into the following technology of chip-making applied sciences. However Intel didn’t really feel the necessity: its CPU manufacturing enterprise relied on the earlier state-of-the-art, deep ultraviolet lithography (DUV). For years the corporate couldn’t resist the revenue margins and free cashflow from persevering with to concentrate on this older know-how. Wall Avenue is at all times hooked on the money machine, even amid diminishing technical momentum, so a lot traders supported the technique.

Learn: The individuals who is perhaps referred to as on to rescue Intel

In the meantime, TSMC constructed up a formidable library of mental property to permit shoppers to design and order extra chipsets simply. It mastered distant collaboration in order that American chip designers didn’t even want to leap on Zoom calls with Taiwan. They may flesh out their newest technical necessities in TSMC’s digital e-foundry, 24 hours a day.

Making huge volumes of chips for cell units enabled TSMC within the mid-2010s to speculate earlier than any rivals within the excessive ultraviolet lithography (EUV) used to fabricate right now’s strongest semiconductors. This made TSMC much more environment friendly, whereas setting a brand new chip-making customary that Samsung and ultimately Intel could be pressured to observe.

The foundering of Intel’s foundry

Gelsinger was keenly conscious of the domino impact from Intel’s smartphone failure. In 2021 he launched Intel Foundry Providers (IFS), a standalone unit providing TSMC-style manufacturing to third-party shoppers. Therefore the funding in additional capability.

Sadly, Intel’s company tradition has eaten this technique for breakfast. An amazing instance was Intel board member Lip-Bu Tan’s resignation in August. Previously the CEO of US chip software program agency Cadence Design Programs, he had solely arrived two years in the past to assist implement Gelsinger’s technique.

In October 2023 he was even put accountable for manufacturing. But he quickly stop in frustration at “the corporate’s lagging workforce, its strategy to contract manufacturing and … risk-averse bureaucratic tradition”.

His departure left a evident hole in semiconductor experience on the board. Intel’s inventory is down 59% in 2024, and the corporate is slicing 15% of its workforce to save lots of $10-billion as IFS has struggled to take off.

But at backside, this can be a disaster for the US. The cherished notion of “design in America, construct in America” is fading. Regardless of TSMC and Samsung creating US manufacturing capability, each corporations will nonetheless profit from their merchandise at dwelling.

Above all, TSMC holds unparalleled chip-making prowess and stays firmly rooted in Taiwan. Taiwan retains the important thing benefits on this trade: mental capital, expert labour and many years of manufacturing know-how.

In the meantime, the Taiwanese-American CEO of Nvidia, Jensen Huang, whose firm dominates the AI chips market, sees no motive to decouple from TSMC. And regardless of how hawkish US political leaders turn into about abroad provide chains, financial information persist: Tesla, as an example, depends on Nvidia’s chips, which rely on TSMC fabrication.

Learn: Intel hoofed off the Dow – to make method for Nvidia

The worldwide nature of chip-making will subsequently not bow to American nostalgia. The US might persuade TSMC and Samsung to open extra amenities within the States, however absolute sovereignty is gone. The departure of Intel’s final true believer underscores that sobering reality.![]()

Get breaking information from TechCentral on WhatsApp. Enroll right here

- The creator, Howard Yu, is professor of administration and innovation, Worldwide Institute for Administration Improvement

- This text is republished from The Dialog beneath a Inventive Commons license. Learn the authentic article