Nervous Nvidia buyers are longing for an replace on its Blackwell chip roll-out — hoping for a catalyst to halt the inventory’s current decline.

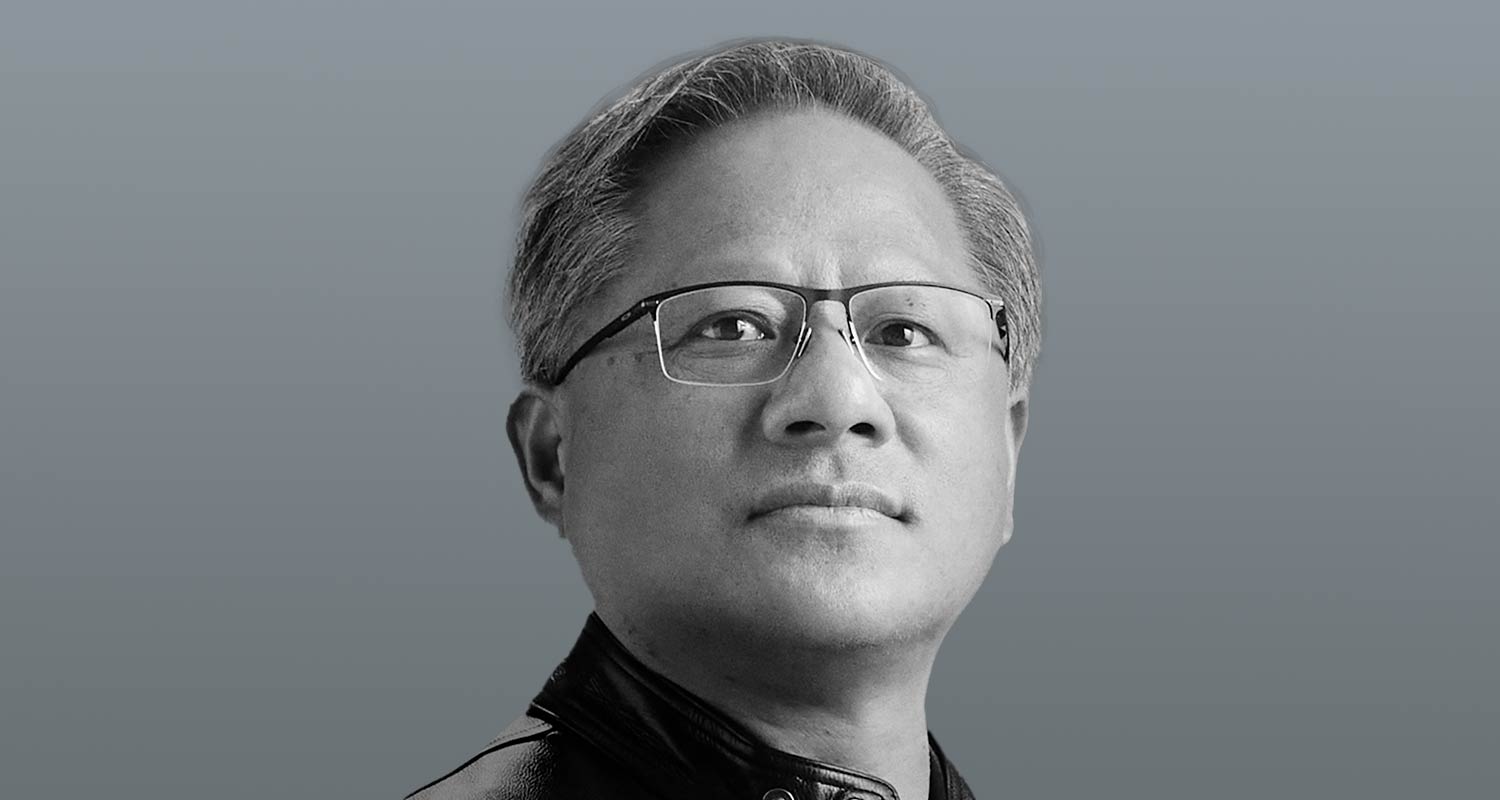

The following-generation processor was unveiled six months in the past however has confronted engineering snags that delayed its launch. Whereas CEO Jensen Huang tried to reassure the market final month that income from the chip is coming quickly, some buyers have been left wanting for particulars. That — together with broader macroeconomic jitters — has contributed to a 15% selloff because the earnings report.

Lingering questions on Blackwell will likely be a key focus when Huang speaks at a Goldman Sachs convention in San Francisco on Wednesday. He’s scheduled to talk with David Solomon, Goldman’s CEO, at 7.20am Pacific time (4.20pm SAST).

“No person likes a delay,” mentioned Brian Mulberry, consumer portfolio supervisor at Zacks Funding Administration. “It’s a kind of blips that buyers are simply type of latching onto.” Within the absence of different constructive catalysts for the inventory — and mixed with broader worries hitting the entire tech sector — the Blackwell snags have added to issues that the synthetic intelligence darling has risen too far, too quick.

Whereas Nvidia has executed job of managing expectations, “they most likely might talk higher, significantly across the Blackwell concern”, Mulberry added.

That sentiment was echoed by Financial institution of America analysts, who wrote in a analysis report final week that particulars in regards to the readiness of Blackwell shipments are the important thing elementary catalyst for a restoration in Nvidia shares.

Points with manufacturing

Blackwell is the subsequent technology of the corporate’s dominant AI processor and has been eagerly awaited by buyers to supply the subsequent leg of progress. Nvidia acknowledged in its newest earnings report that there have been points with manufacturing and mentioned it has needed to revamp a part of the chip’s manufacturing course of.

Nonetheless, the corporate mentioned it expects to usher in “a number of billion {dollars}” of income from Blackwell in its fiscal fourth quarter, which ends on 31 January. The manufacturing ramp is scheduled to start within the fourth quarter and proceed into fiscal 2026, in keeping with feedback on the earnings name.

Learn: Nvidia suffers report R5-trillion one-day loss in market worth

If every part goes easily and Nvidia is ready to ship its Blackwell chips on this schedule, then the inventory could turn out to be much less unstable than in current months, Mulberry mentioned.

They’ve mentioned they’ll be capable of deliver issues up to the mark by early 2025, and “if they will talk clearly that they’re nonetheless on monitor to do this and there received’t be any additional delays in manufacturing, they will quell a few of these short-term fears”, he mentioned.

Nonetheless, if Blackwell faces extra delays or snags, that would add to draw back strain on the shares — particularly with few different catalysts on the horizon and potential dangers associated to a US justice division antitrust probe.

Nonetheless, if Blackwell faces extra delays or snags, that would add to draw back strain on the shares — particularly with few different catalysts on the horizon and potential dangers associated to a US justice division antitrust probe.

Randy Hare, portfolio supervisor at Huntington Nationwide Financial institution, agrees that near-term strain on Nvidia shares is prone to the draw back. Nonetheless, for buyers who imagine within the potential of AI within the long-term, it may very well be time so as to add to positions.

“We’re perhaps half method by means of the mid-cycle correction,” mentioned Hare. “After which I feel you’ll get alternative the place individuals will realise that that is the perfect progress space out there they usually’ll begin placing cash to work once more.” — Carmen Reinicke, (c) 2024 Bloomberg LP