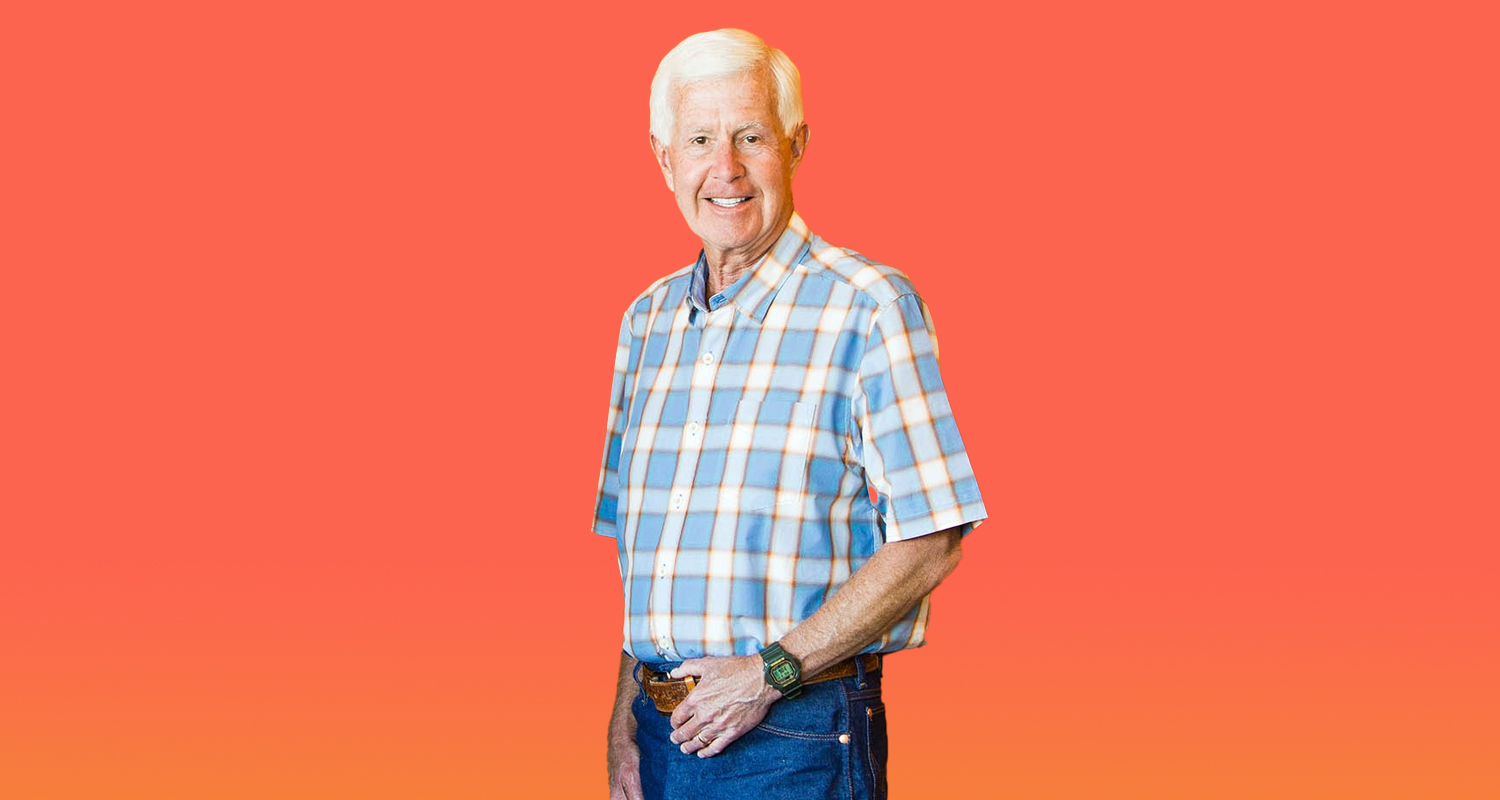

Dave Duffield retains attempting, and failing, to retire. At 84, the billionaire co-founder of HR software program corporations PeopleSoft and Workday is constructing one other start-up after he grew to become “bored foolish” every time he stopped working.

“I attempted to make mannequin aeroplanes and failed, rocked away on the again porch, kind of failed at that, too,” Duffield stated with amusing from his new firm’s workplace on the shore of Lake Tahoe in Incline Village, Nevada, US. He additionally performed “hours and hours” of FreeCell, a web-based model of solitaire.

Duffield doesn’t do something by half measures. His stressed and aggressive spirit drove him to begin six corporations, together with two that he took public. He has 10 youngsters, two foundations and a web value of US$15.4-billion, based on the Bloomberg Billionaires Index. And people FreeCell video games? He was one of many prime gamers on this planet, stated his daughter Amy Zeifang.

“Perhaps he performed FreeCell, however he performed to win it and be one of the best,” she stated.

Now Duffield is aiming for a brand new milestone: finishing a uncommon IPO hat trick and taking a 3rd (and he claims final) firm public. His newest gambit is Ridgeline, a cloud-based platform for the investment-management business that goals to convey the whole lot from buying and selling to accounting to compliance beneath one umbrella.

Since beginning Ridgeline in 2017, he’s invested about $400-million of his personal cash into the enterprise. It now has a dozen clients and is doubling that because it provides further shoppers together with Allen & Co, the New York funding financial institution. It’s eyeing an preliminary public providing within the subsequent few years because it targets $1-trillion of property on the platform and a income run price of $150-million. It at present has over $200-billion on the platform; Ridgeline wouldn’t disclose its income.

First he’ll should show that his affable persona and trademark company tradition — primarily based on the concept that pleased staff make for pleased clients — can work within the cutthroat monetary companies business.

Massive breakout

PeopleSoft was Duffield’s huge breakout firm when it went public in 1992, however not his first. A Cornell College graduate who grew up in Ho-Ho-Kus, New Jersey, US, Duffield started his profession as a techniques engineer at IBM. He left 4 years later to begin his first firm, which designed software program for scheduling faculty exams, earlier than shifting to Silicon Valley within the early Seventies. There he launched into his subsequent two ventures, each centered on human assets and payroll.

A administration conflict led Duffield to promote his inventory in his third firm, mortgage his home and begin PeopleSoft in 1987. He endeared himself to his staff by pioneering Silicon Valley’s enjoyable workplace tradition, from informal apparel to a company band referred to as the Raving Daves.

That sense of a private relationship along with his staff made it even tougher on Duffield when Larry Ellison’s Oracle approached with a hostile takeover provide in 2003. PeopleSoft’s board fired its CEO and requested Duffield — who was retired for the primary time — to return and lead it by a bitter combat that ended with a $10.3-billion deal in December 2004.

TCS | Scott Gibson on his new function as Pragma CEO

A month later, Oracle reduce 5 000 of PeopleSoft’s 11 000 staff, a turning level in Duffield’s profession that he’s referred to as the worst second of his life.

He was “exhausted” however somewhat than easing again into retirement, he went to satisfy his former co-worker Aneel Bhusri at a diner on the California aspect of Lake Tahoe. Impressed by what Marc Benioff was doing with Salesforce and the cloud, they began Workday in 2005 — risking the wrath of PeopleSoft’s new proprietor, who out of the blue confronted recent competitors.

“I give Larry credit score for not suing us, as a result of that will have been an easy factor to do,” Duffield stated. “If nothing else, he might have slowed us down or compelled us out of enterprise, however he didn’t.”

Oracle didn’t reply to a request for remark.

Ellison’s corridor move gave Workday the room to develop right into a $64-billion firm, the place Duffield stays the biggest particular person shareholder with a $10.6-billion stake, based on Bloomberg’s wealth index. He introduced his “pleased buyer, pleased worker” method to his new enterprise and purchased shares of each one among its publicly traded clients — what he referred to as the Workday 100. (He claims it outperformed the Dow Jones Industrial Common.)

“We didn’t go overboard attempting to be worthwhile,” he stated. “We earned our profitability from having our staff be pleased working laborious, loving what they do, and our clients loving what we did for them, and telling others about us.”

Duffield determined to retire as Workday’s co-CEO in 2014. He and his spouse had adopted their tenth and final little one, and he needed to return to Incline Village so their daughter might go to the varsity that he helped begin in the neighborhood. However, regardless of remaining on the Workday board till 2022, he discovered himself bored as soon as once more.

“FreeCell wasn’t as outstanding, however nonetheless outstanding,” he joked.

To nobody’s shock, Duffield determined to return to work. He enlisted Jack Lynch, a former IBM worker who he met at a lodge bar in Hawaii, to brainstorm concepts. The main contender: to problem the dominance of healthcare software program agency Epic Programs with a brand new billing device.

That was promptly scrapped in a pitch assembly with Allen & Co MDs Ashok Chachra and George Tenet, the previous director of the Central Intelligence Company.

Becoming capstone

“Ashok actually will get up and says one thing to the impact of, ‘That’s whole bullshit. That’s the worst factor you might ever do,’” Duffield stated.

Chachra later admitted he “was actually blunt”, telling them that it was already a crowded discipline and would take years simply to catch up technologically to the place Epic and others have been. It wasn’t a becoming capstone for Duffield’s profession, he stated.

Requested what he would do as an alternative, Chachra outlined an funding business answer with buying and selling, accounting and CRM all constructed into one platform. The concept was that at each stage, from the typical US family to institutional buyers, there’s no system of report that gives full transparency and accountability in a single place.

Learn: SAP workers morale plunges

And if Duffield constructed it, Chachra instructed him Allen & Co can be his first buyer. In actual fact, it grew to become Ridgeline’s eleventh, with Tenet becoming a member of the startup’s board in 2021.

Peter Heckmann, an analyst at DA Davidson, sees a chance for Ridgeline to get to a whole bunch of tens of millions of {dollars} in income. The funding administration business is lagging technologically however beginning to see a couple of breakthrough start-ups difficult giant incumbents like SS&C Introduction, Heckmann stated. He pointed to Clearwater Analytics Holdings, a competitor that’s extra centered on the insurance coverage business, which reported income of $368-million final 12 months.

Duffield’s son Mike, who’s vice chairman of gross sales for Ridgeline, thinks his dad finally discovered the precise area of interest in an business with pent-up demand for higher know-how. Nonetheless, he acknowledged it’s been difficult to persuade funding corporations to make the leap.

Duffield’s son Mike, who’s vice chairman of gross sales for Ridgeline, thinks his dad finally discovered the precise area of interest in an business with pent-up demand for higher know-how. Nonetheless, he acknowledged it’s been difficult to persuade funding corporations to make the leap.

“It’s open-heart surgical procedure on their enterprise techniques and nobody desires to run in the direction of that,” stated Mike Duffield, 54, who beforehand labored for his father at PeopleSoft and Workday. “However finally, it’s higher for them long run.”

To persuade them, Duffield turned to Dave Blair, a 28-year veteran of SS&C Introduction who introduced the business information to Duffield’s imaginative and prescient. In Might, Blair accomplished a multiyear transition to change into sole CEO. Duffield will stay the corporate’s chairman.

Blair, 57, stated there’s super stress to get it proper when coping with trades or cash transfers. Add in new synthetic intelligence options, which Ridgeline is at present constructing, and the scepticism — and potential payoff — improve.

After some early missteps, beginning with buyers whose portfolios have been too area of interest and sophisticated, Ridgeline now helps half a dozen asset lessons from equities and ETFs to bonds. It at present has 400 staff and has opened further workplaces in New York, the San Francisco Bay space and Reno, Nevada, because it races to $1-trillion in property on the platform.

“If we add one foundation level of effectivity, that’s $100-million that goes again to the top investor,” Blair stated. “In order that effectivity — and I feel we are able to do rather a lot higher than one foundation level — actually offers us function.”

Too busy to be bored

Despite the fact that Duffield has as soon as once more handed over his CEO title, he claims he’s too busy with the corporate, his philanthropy and his household to be bored. His youngest daughter simply entered highschool, he has a weekly assembly with Blair and a month-to-month assembly with the headmaster of Lake Tahoe College, which he helped begin and has donated over $25-million to. His truck — appropriately, a Honda Ridgeline — continues to be a fixture outdoors Ridgeline’s Incline Village workplace.

What gained’t be a spotlight is politics, regardless of a $1-million donation to Donald Trump in 2020.

“I’m unsure I’d have performed that once more, as a result of on the time it was destructive for Workday that I did that, and I’m the final man that wishes to harm Workday,” he stated. “I’d somewhat spend my time serving to create value, on this case Ridgeline, for the good thing about the folks that come after me.”

Learn: Buyers out of the blue can’t get sufficient of this five-decade-old software program firm

Duffield’s charity work is embarking on its subsequent chapter, too. His Maddie’s Fund basis, which was pivotal in main the no-kill shelter motion and best-in-class practices for animal shelters, is now working with house owners to maintain animals out of shelters within the first place.

The Dave & Cheryl Duffield Basis additionally has a brand new moonshot philanthropic purpose: serving to remedy post-traumatic stress dysfunction in veterans. Duffield and his spouse, together with an area developer, are constructing out a 27-acre website in Reno for Liberty Canines, a brand new basis that may pair 200 disabled veterans a 12 months with service canines.

His foundations will inherit his wealth when he and his spouse die, and his kids say they may proceed to honour his needs of their work. Reflecting on their dad’s legacy, his kids Amy and Mike level to what he’s created for different folks, from staff at his start-ups to his barber, an early investor in PeopleSoft.

On a Friday in August, Duffield and his spouse sat down for dinner at an area restaurant they co-own. His web value had risen $1.2-billion that day as Workday shares jumped 12% following a optimistic earnings report. When he walked in, the restaurant proprietor came visiting and excitedly instructed him that he’d made $17 000 that day having invested within the firm too. Dinner, it might end up, was on the home. — Biz Carson, (c) 2024 Bloomberg LP