- Africa’s startup funding ecosystem skilled a decline in 2024, with whole investments dropping by 25% to $2.2 billion amidst a worldwide financial slowdown.

- Nonetheless, a powerful rebound within the second half, pushed by two unicorn offers, highlighted the sector’s resilience and potential.

- Regional leaders Kenya, Nigeria, and Egypt continued to dominate, signaling sustained investor curiosity regardless of the challenges.

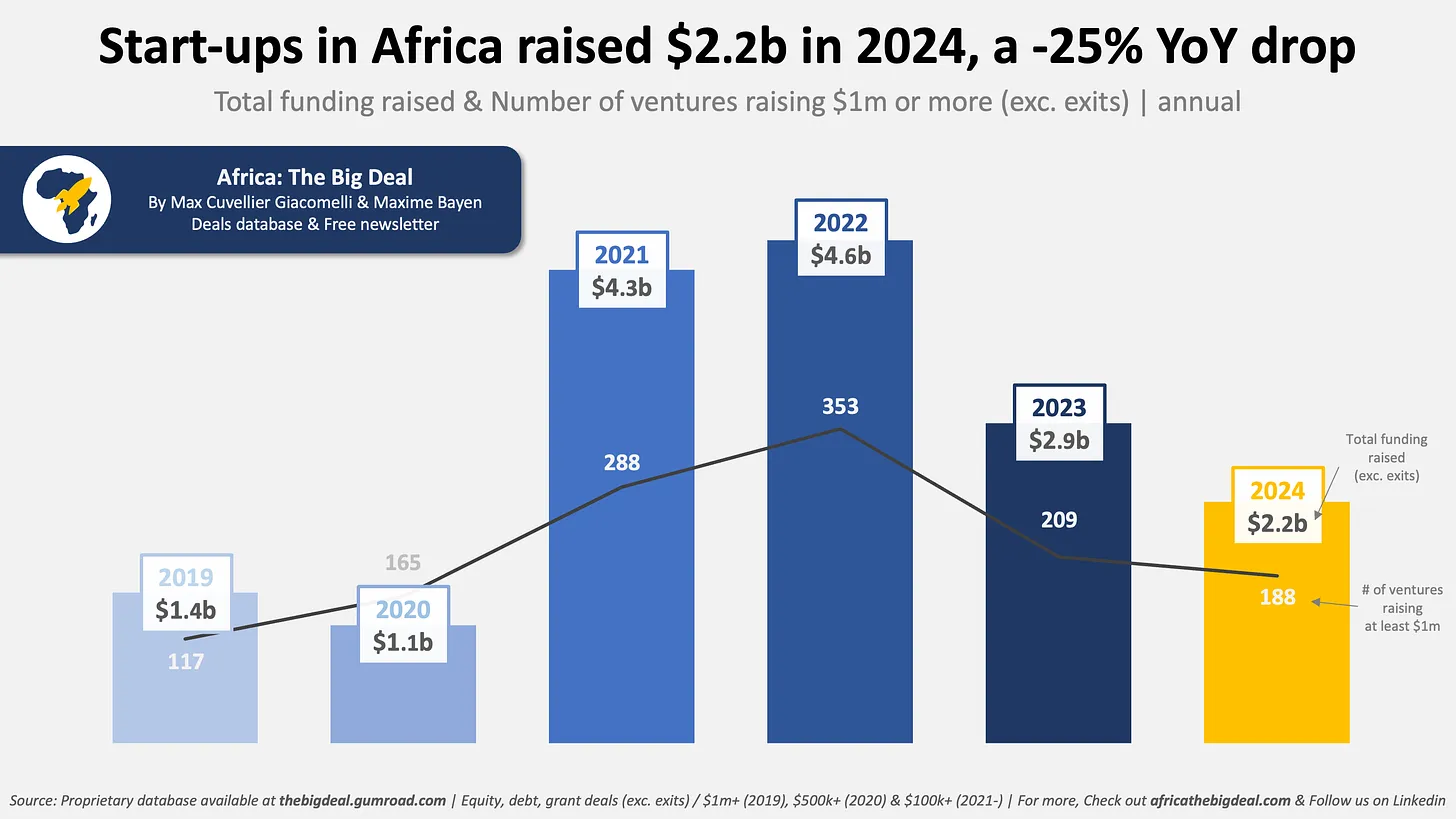

Africa’s startup funding ecosystem skilled a notable decline in 2024, reflecting the broader international funding drought that outlined the 12 months. Startups on the continent collectively raised $2.2 billion in fairness, debt, and grants (excluding exits), a considerable quantity however a pointy 25 per cent drop in comparison with the $2.9 billion secured in 2023.

Regardless of the downturn, the 12 months was marked by pockets of resilience, strategic wins, and a glimpse of restoration within the latter half, an annual evaluation by Africa: The Large Deal exhibits.

Startup funding in Africa

In 2024, an estimated 188 startups managed to lift $1 million or extra, a lower of simply 10 per cent from 2023. This highlights that whereas funding quantities shrank considerably, the variety of funded ventures remained comparatively steady.

On the exit entrance, the 12 months noticed 22 offers disclosed, up barely from 20 in 2023, signaling cautious optimism in funding returns amidst a difficult atmosphere.

The 12 months’s funding trajectory revealed two contrasting halves. The primary six months of 2024 had been significantly difficult, with just below $800 million raised—a determine harking back to pre-pandemic funding ranges in 2020.

Nonetheless, the second half of the 12 months noticed a dramatic rebound, with startups elevating $1.4 billion. This represented a 25 per cent year-on-year development and an 80 per cent improve in comparison with H1, marking it because the second-best half-year because the onset of the worldwide funding downturn in mid-2022.

Mega offers drive a late-year surge

In accordance with Africa: The Large Deal, the restoration in H2 was pushed partially by two important offers involving Moniepoint and Tyme Group in This autumn, each of which minted new unicorns—firms valued at over $1 billion.

These back-to-back achievements had been the primary of their sort since early 2023, underscoring the significance of enormous offers in revitalizing Africa’s startup funding ecosystem.

Whereas fairness financing skilled a comparatively modest decline of 11 per cent year-on-year ($1.5 billion in 2024 versus $1.7 billion in 2023), debt funding took a extra important hit, contracting by 40 per cent. This shift displays altering investor methods, with a stronger concentrate on fairness amid tightening credit score circumstances globally.

Regional efficiency in startup funding

The same old suspects in attracting startup funding in Africa continued to dominate the market. In Jap Africa as an illustration, Kenya continued to draw the lion’s share of startup funding, solidifying its place as a regional hub for innovation and entrepreneurship.

Africa’s largest financial system Nigeria maintained its dominance as the biggest recipient of startup capital, reaffirming its function as a cornerstone of the African tech ecosystem in Western Africa.

Within the Central Africa area, the Democratic Republic of Congo (DRC) emerged as an sudden chief in startup funding inside the area, reflecting rising investor curiosity in untapped markets.

For Northern Africa, Egypt was the prime vacation spot of alternative for startup capital, leveraging its strategic location and rising ecosystem. Within the Southern Africa base, South Africa remained the biggest vacation spot for startup funding, pushed by its mature market infrastructure and vibrant entrepreneurial tradition.

Learn additionally: African startups hit by funding drought in 2024, however innovation persists

Broader implications for Africa’s startup ecosystem

The decline in funding underscores the challenges African startups face in navigating the worldwide financial slowdown and tightening investor confidence. The so-called “funding winter,” which started in mid-2022, continues to solid an extended shadow over the ecosystem.

Nonetheless, the resilience proven in H2 2024 gives a glimmer of hope. The rebound not solely highlighted Africa’s potential to draw important funding but additionally demonstrated the flexibility of startups to adapt and innovate within the face of adversity.

Africa’s rising ecosystem stays a pretty proposition for traders searching for high-growth alternatives. The emergence of recent unicorns, coupled with regular development in areas like Jap and Northern Africa, alerts that the continent’s startup scene continues to be brimming with potential.

Whereas 2025 stays fraught with challenges, Africa’s startups have confirmed their mettle in navigating turbulent instances. The sector’s means to draw $2.2 billion in funding throughout a worldwide downturn is a testomony to its resilience and untapped potential.

Unlocking additional development would require a mix of strategic investments, authorities assist, and progressive options to deal with infrastructure and funding gaps. As the worldwide financial system stabilizes, Africa’s startup ecosystem is well-positioned to bounce again, leveraging its distinctive strengths and vibrant entrepreneurial spirit.