Emulating US know-how firm MicroStrategy, South African-listed funding holding firm Altvest Capital has introduced plans so as to add bitcoin to its treasury.

In a small first transfer, Altvest – via its wholly owned subsidiary, Altvest Bitcoin Methods – has acquired 1.00464 bitcoin for R1.81-million as a part of what it described as its “long-term treasury administration technique”.

“This initiative is targeted on preserving shareholder worth, mitigating forex depreciation dangers and gaining publicity to a globally recognised retailer of worth,” Altvest mentioned in a press release to buyers on Friday.

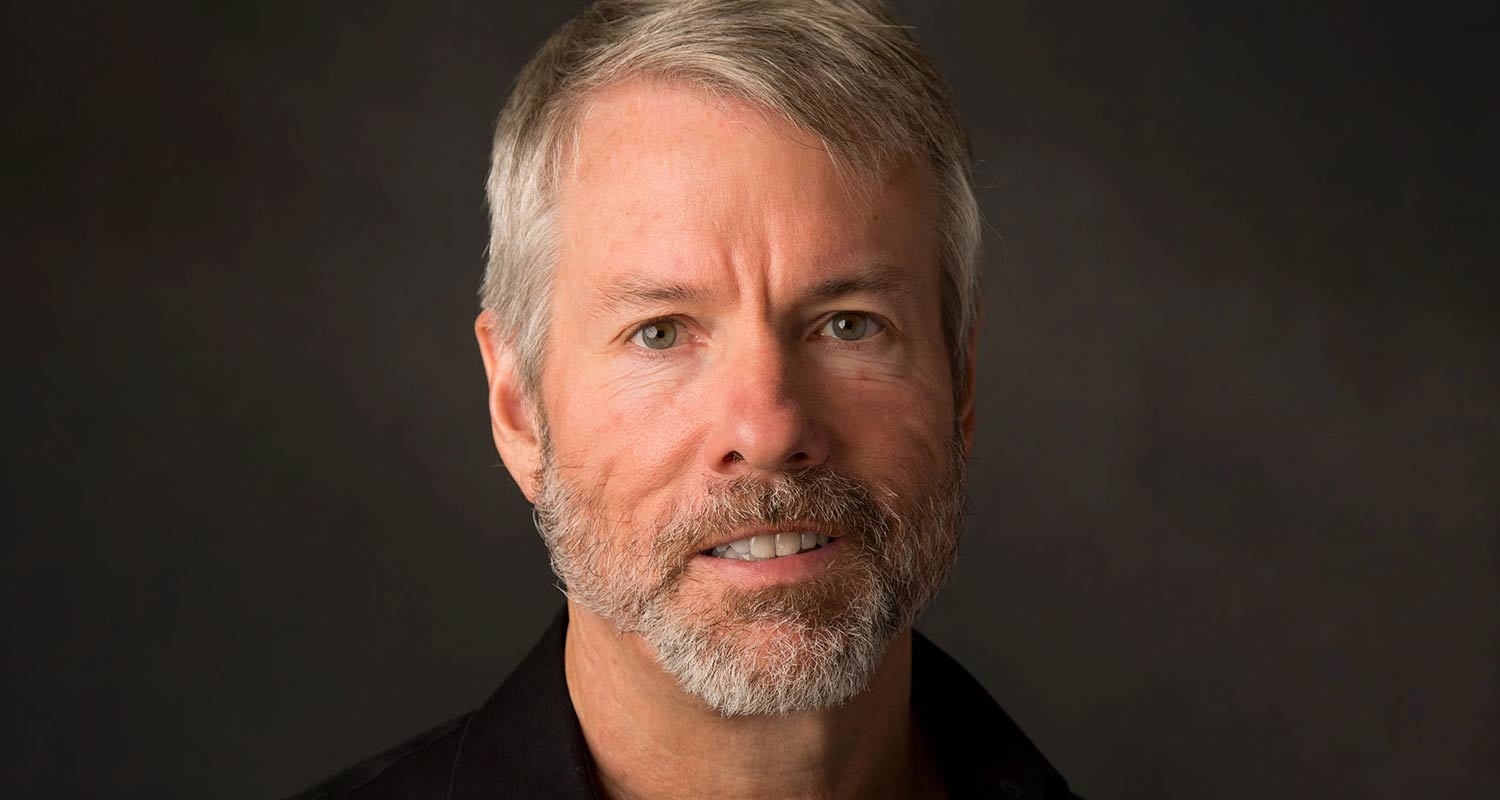

The transfer emulates a choice by MicroStrategy (now Technique) CEO Michael Saylor numerous years in the past to take a position vital cash shopping for bitcoin for the corporate’s treasury. As of 10 February 2025, Technique held 478 740 bitcoins in its treasury value a staggering US$47-billion on the time of writing.

Altvest mentioned its choice to allocate capital to bitcoin relies on the “distinctive and confirmed” attributes of the cryptocurrency. It mentioned these are its fastened provide (solely 21 million will ever be “minted”), its decentralised nature, rising institutional adoption, its liquidity and safety, and its rising regulatory recognition in South Africa and globally. Altvest’s share value was unchanged at R6.50 shortly after markets opened in Johannesburg on Friday.

“The board of Altvest has performed a complete danger evaluation and decided that bitcoin aligns with Altvest’s various asset funding philosophy. It gives long-term development potential whereas serving as a hedge in opposition to macroeconomic dangers, notably the depreciation of the rand. Moreover, Altvest has carried out a structured danger administration framework to observe and optimise bitcoin publicity in step with treasury aims,” the corporate mentioned.

‘Essentially totally different’

It mentioned it has no plans “at this stage” to put money into cryptocurrencies aside from bitcoin. “Altvest will proceed to evaluate market circumstances and technological developments however at the moment sees bitcoin as the one digital asset that meets its stringent funding standards for a long-term treasury allocation.”

Altvest CEO Warren Wheatley mentioned in a press release that bitcoin is “essentially totally different” from different digital property.

TCS | Springboks rugby deal: the tech plan behind the audacious bid

“It’s the solely really decentralised, scarce and globally recognised digital asset that aligns with Altvest’s funding philosophy. We see bitcoin as a strategic reserve asset that enhances our treasury portfolio whereas offering a hedge in opposition to financial instability and forex depreciation.”

Altvest’s board is chaired by well-known South African know-how entrepreneur and self-described “bitcoin maximalist” Stafford Masie, who has additionally been lobbying for the nation to incorporate bitcoin in its strategic reserve.

Altvest mentioned all its bitcoin-related treasury actions will “absolutely adjust to related monetary laws and reporting necessities”.

“Altvest Capital will proceed to observe its bitcoin holdings in response to market circumstances, regulatory developments and its overarching funding technique. The corporate stays dedicated to accountable and clear capital allocation, making certain all investmetns align with its mission of other asset publicity for long-term worth creation.” — © 2025 NewsCentral Media

Get breaking information from TechCentral on WhatsApp. Join right here.

Don’t miss:

Who was bitcoin’s Satoshi Nakamoto? I must know, and so do you