- In July, South Africa’s personal sector posted the quickest fall in output and new orders since March

- Official statistics present that the nation’s inflation was at a close to four-year low.

- Enterprise confidence was nevertheless on the highest ranges since February 2022.

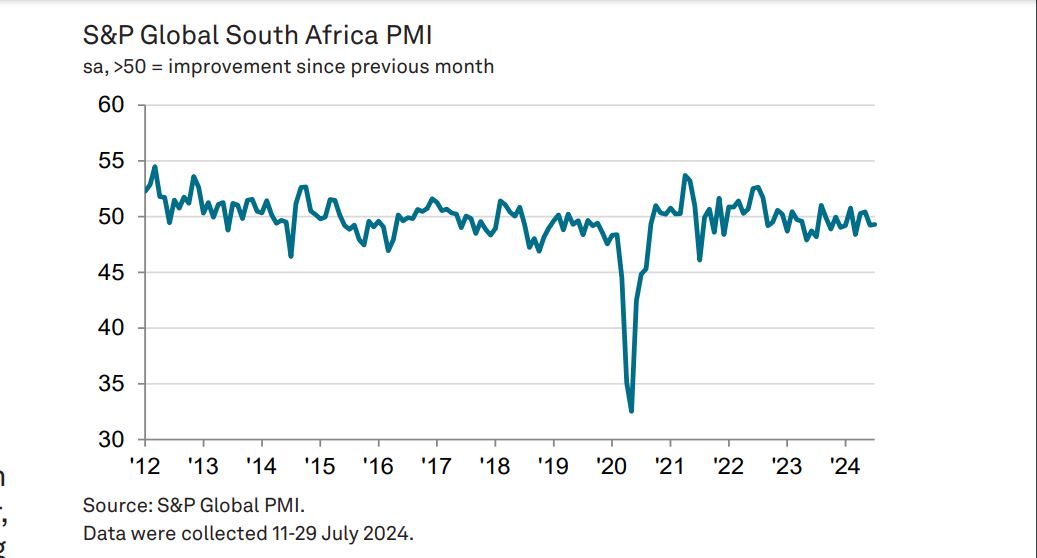

As South Africa stepped into the second half of 2024, the nation’s economic system continued to face challenges, with the personal sector contracting for the second month in a row.

The most recent Buying Managers’ Index (PMI) report from S&P World paints a posh image—whereas the contraction deepened in July, there are additionally indicators of optimism that might sign a brighter future.

A deepening contraction in South Africa’s personal sector

The S&P World South Africa PMI for July registered at 49.3, a slight decline from June’s 49.2. Whereas the change could seem minor, it’s vital because it marks the second month in a row that the PMI has remained under the impartial 50.0 threshold, indicating a continued contraction within the personal sector.

The July studying additionally represents the sharpest drop in output and new enterprise in 4 months, suggesting that South Africa’s personal sector continues to be grappling with a difficult financial setting.

This contraction was unfold throughout all sectors lined by the survey, with corporations reporting a noticeable decline in output. The downturn in output was largely attributed to a drop in new enterprise, as shoppers restricted spending in response to subdued financial circumstances.

The sharp decline in each exercise and demand underscores the fragility of South Africa’s personal sector, which stays weak to each home and world financial pressures.

David Owen, Senior Economist at S&P World Market Intelligence, highlighted the continued challenges: “Demand and provide challenges remained current within the South African personal sector as we started the second half of 2024, with new orders persevering with to say no and provider efficiency worsening as world transport points and home port congestion hindered distributors.”

Provide chain struggles: Port congestion and supply delays

One of the vital vital elements contributing to the contraction in South Africa’s personal sector is the continued wrestle with provide chain disruptions.

The PMI report pointed to a sooner deterioration in vendor efficiency in July, with lead instances worsening to the best extent since February 2024. This deterioration was largely pushed by port congestion, each domestically and overseas, which has hampered the flexibility of suppliers to ship items on time.

These provide chain challenges have had a ripple impact on the broader economic system. Many corporations reported that slower deliveries had curtailed their exercise, forcing them to run down inventories to finalize present contracts.

This depletion of enter shares, mixed with decreased purchases and a back-to-back lower in employment, highlights the tough selections that companies are being pressured to make as they navigate an more and more difficult setting.

The impression of those provide chain disruptions is clear within the PMI knowledge, with backlogs of labor lowering on the quickest price since November 2023. The modest fall in whole enter shares, the quickest noticed thus far in 2024, underscores the pressure that South African companies are below as they try to take care of operations within the face of persistent logistical challenges.

Easing inflationary pressures: A silver lining?

Regardless of the grim outlook offered by the PMI report, some silver linings provide hope for South Africa’s personal sector. One of the vital encouraging findings is the continued easing of inflationary pressures.

Though enter prices rose at a faster tempo than in June, the general price of enter price inflation remained one of many weakest recorded since late 2020.

This easing of inflationary pressures is especially necessary given the context of South Africa’s latest financial historical past, the place companies have struggled with rising prices for supplies, electrical energy, and wages.

In July, the PMI knowledge indicated that whereas some corporations did face larger prices, these will increase have been comparatively gentle in comparison with the numerous value hikes seen in earlier years.

David Owen famous the significance of those tendencies: “The PMI survey knowledge continued to again up the latter, with enter value inflation nonetheless at a a lot cooler tempo in comparison with latest tendencies and output prices rising on the slowest price in practically 4 years. This ought to be encouraging for the Reserve Financial institution who will likely be in search of indicators as to when financial coverage will be eased.”

The slower rise in output costs, noticed in July, suggests that companies are discovering methods to soak up a few of these prices somewhat than passing them on to shoppers. Whereas this may occasionally put stress on revenue margins, it additionally helps to assist demand by retaining costs extra inexpensive for patrons.

In an setting the place demand circumstances stay fragile, this balancing act between price administration and pricing technique is essential for sustaining enterprise exercise.

Learn additionally: South Africa’s deepening funding ties in South Sudan oil business

A glimmer of optimism: Political stability and enterprise confidence

Amidst the challenges dealing with South Africa’s personal sector, there’s a notable enhance in enterprise confidence that might sign a turning level for the economic system.

The PMI report revealed that enterprise confidence improved in July, rising to its highest degree in practically two-and-a-half years. This surge in optimism is basically attributed to expectations of higher political stability following the final election, which many corporations consider will assist enhancements in demand and exercise.

The anticipation of a extra secure political setting is a essential think about bolstering enterprise confidence. Lately, political uncertainty has been a major drag on South Africa’s economic system, with companies reluctant to speculate or increase within the face of potential coverage shifts.

The prospect of a extra predictable and secure political panorama is subsequently a welcome growth for the personal sector, providing hope that the worst of the contraction could quickly be behind us.

Moreover, the PMI report highlighted the optimistic impression of decreased load shedding and softer value pressures, that are anticipated to assist progress within the coming months. Load shedding, or rolling blackouts, has been a serious problem for South African companies, disrupting operations and growing prices.

The easing of this burden, mixed with the softer rise in costs, offers a extra favorable working setting that might assist to reverse the present downturn.

Navigating a difficult economic system

The July PMI report for South Africa underscores the complexity of the challenges dealing with the personal sector because it navigates a tough financial panorama.

The deepening contraction in output and new enterprise, pushed by provide chain disruptions and subdued demand, highlights the vulnerability of South Africa’s economic system to each home and world pressures.

Nevertheless, amidst these challenges, there are indicators of hope. The easing of inflationary pressures, the prospect of higher political stability, and the rise in enterprise confidence all level to the potential for a turnaround within the coming months.

Whereas the street forward stays unsure, these vibrant spots provide a glimmer of optimism that South Africa’s personal sector could but discover its footing and emerge stronger from the present downturn.

As companies look to the long run, the important thing will likely be to construct on these optimistic developments, leveraging the alternatives offered by a extra secure political setting and a much less inflationary backdrop.

By doing so, South Africa’s personal sector can start to recuperate from the latest contraction and lay the muse for sustained progress within the years to return.